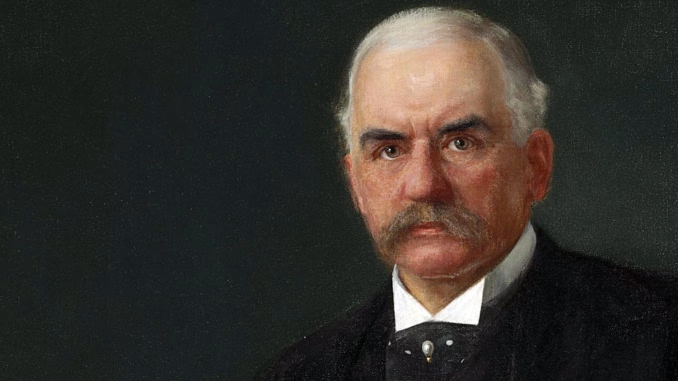

John Pierpont Morgan, known as J.P. Morgan, was a towering figure in American finance, whose banking empire shaped the modern economy during the Gilded Age. As the founder of J.P. Morgan & Co., he orchestrated major corporate mergers, stabilized financial crises, and amassed influence that rivaled governments.

His strategic vision and philanthropy left a lasting mark on industry, art, and education. This biography explores Morgan’s early life, career, major contributions, and enduring legacy.

Early Life and Background

John Pierpont Morgan was born on April 17, 1837, in Hartford, Connecticut, to Junius Spencer Morgan, a prosperous banker, and Juliet Pierpont, a poet’s daughter. The eldest of five children, Morgan grew up in a privileged family with deep roots in New England’s mercantile elite. His father’s success in international banking exposed young Morgan to finance early, fostering a sense of discipline and ambition.

Morgan’s education was rigorous. He attended private schools in Boston and Switzerland, mastering French and German. A childhood bout with rheumatic fever left him frail but determined. At age 20, he studied at the University of Göttingen in Germany, excelling in mathematics. His cosmopolitan upbringing and analytical mind prepared him for a career in global finance. In 1857, he began work at his father’s London-based firm, gaining experience in international trade before returning to New York.

| Key Details of Morgan’s Early Life | Information |

| Birth Date | April 17, 1837 |

| Birthplace | Hartford, Connecticut, USA |

| Parents | Junius Spencer Morgan (father), Juliet Pierpont (mother) |

| Education | Private schools, University of Göttingen |

| Early Interests | Mathematics, finance, international trade |

Education and Early Career

Morgan’s formal education ended at Göttingen, but his training in banking was hands-on. In 1857, he joined Duncan, Sherman & Co. in New York, a partner of his father’s firm, learning the intricacies of trade financing. By 1860, he served as an agent for his father’s London bank, J.S. Morgan & Co., navigating transatlantic commerce during the Civil War. His early ventures included controversial deals, like financing a shipment of rifles for the Union, which drew scrutiny for profiteering.

In 1871, Morgan partnered with Anthony Drexel to form Drexel, Morgan & Co., a New York-based bank specializing in corporate finance and international loans. His reputation for integrity and decisiveness grew, positioning him as a leading banker by the 1880s. After Drexel’s death in 1893, Morgan reorganized the firm as J.P. Morgan & Co., cementing his control.

| Morgan’s Early Career Milestones | Details |

| 1857 | Joined Duncan, Sherman & Co. |

| 1871 | Co-founded Drexel, Morgan & Co. |

| 1893 | Established J.P. Morgan & Co. |

| Key Strength | Financial strategy |

Financial Career and Major Contributions

Morgan’s career redefined banking through corporate consolidation, crisis management, and philanthropy:

Corporate Mergers and Trusts

Morgan was a master of “Morganization,” restructuring industries through mergers to eliminate competition and boost efficiency. Key achievements include:

- U.S. Steel (1901): Morgan orchestrated the $1.4 billion buyout of Andrew Carnegie’s steel empire, merging it with other firms to create U.S. Steel, the world’s first billion-dollar corporation. It controlled 60% of U.S. steel production, per 2025 economic analyses.

- General Electric (1892): He facilitated the merger of Edison General Electric and Thomson-Houston, forming a global leader in electrical manufacturing.

- Railroads: Morgan reorganized bankrupt railroads like the Northern Pacific and Erie, stabilizing their finances and modernizing operations, which unified America’s rail network.

His trusts centralized industries but sparked antitrust scrutiny, influencing the 1913 Pujo Committee’s banking reforms.

Financial Crisis Management

Morgan’s influence stabilized the U.S. economy during crises:

- Panic of 1893: He arranged loans to replenish U.S. gold reserves, averting national bankruptcy.

- Panic of 1907: Morgan personally led bankers to bail out failing institutions, saving Wall Street. His actions prompted the creation of the Federal Reserve System in 1913, reducing reliance on private bankers.

Banking Innovations

Morgan pioneered investment banking, underwriting corporate bonds and stocks to fund railroads, steel, and utilities. His firm’s international reach facilitated European investment in American industry, strengthening transatlantic finance. J.P. Morgan & Co.’s disciplined lending practices set standards for modern banking, per 2025 Bloomberg reports.

Philanthropy

Morgan’s wealth funded cultural and educational institutions:

- Metropolitan Museum of Art: He donated thousands of artworks, serving as a trustee and president.

- Morgan Library: His private collection of rare books and manuscripts, opened to the public in 1924, remains a research hub.

- Education and Charity: He supported Harvard Medical School, the American Red Cross, and Episcopal churches.

| Major Morgan Contributions | Year | Impact |

| U.S. Steel Formation | 1901 | Created first billion-dollar corporation |

| Panic of 1907 Resolution | 1907 | Stabilized U.S. economy |

| General Electric Merger | 1892 | Shaped electrical industry |

| Morgan Library | 1924 | Preserved cultural heritage |

Academic and International Recognition

Morgan held no academic posts but was globally revered:

- Financial Influence: J.P. Morgan & Co. financed governments and corporations, earning Morgan the title “America’s Banker.”

- Honors: Received accolades from European monarchs and U.S. leaders for his economic interventions.

- Legacy Firms: JPMorgan Chase, formed through mergers, is a top global bank in 2025, per Fortune.

Recent 2025 exhibits at the Morgan Library, per its website, showcase his art collection, while X posts highlight his role in shaping modern finance, though some critique his monopolistic power.

Political and Social Views

Morgan was a conservative Republican, favoring laissez-faire economics and minimal regulation. He supported high tariffs to protect American industry and backed William McKinley’s gold standard policies. His immense influence—brokering deals that rivaled government power—drew Progressive Era criticism, with reformers like Theodore Roosevelt targeting his trusts.

Socially, Morgan was an Episcopalian, supporting religious charities but maintaining an elitist outlook. He avoided labor issues, delegating them to managers, and showed little interest in social reforms like women’s suffrage. On X in 2025, users debate his economic stabilization versus his consolidation of wealth, reflecting his divisive legacy.

Personal Life

Morgan married twice. In 1861, he wed Amelia Sturges, who died of tuberculosis months later. In 1865, he married Frances Louisa Tracy, with whom he had four children: Louisa, John Pierpont Jr., Juliet, and Anne. Frances managed their New York and London homes, while Morgan focused on business and art collecting.

He enjoyed yachting, owning the Corsair, and traveled extensively to Europe, amassing art and rare books. Known for his imposing presence and piercing gaze, Morgan was private, shunning publicity. His rhinophyma, a nasal condition, fueled caricatures but never deterred his confidence. He died on March 31, 1913, in Rome, Italy, at age 75, from a heart ailment.

| Personal Life Highlights | Details |

| Marriages | Amelia Sturges (1861), Frances Tracy (1865–1913) |

| Children | Louisa, John Jr., Juliet, Anne |

| Hobbies | Yachting, art collecting, travel |

| Notable Trait | Reserved intensity |

Leadership Style and Ideology

Morgan’s leadership was authoritative and discreet. He operated through trusted partners, like Charles Schwab, and made swift, decisive deals, often in private. His ideology championed stability and efficiency, believing strong corporations drove progress. His ability to rally bankers during crises, as in 1907, showcased his command, earning him the moniker “Jupiter” of Wall Street.

Morgan distrusted populist reforms, prioritizing elite control of finance. His belief in “gentleman’s agreements” shaped banking ethics, a topic explored in 2025 PBS documentaries comparing him to modern financiers like Jamie Dimon.

Legacy and Impact

Morgan’s contributions transformed finance and culture:

- Banking: J.P. Morgan & Co. set standards for investment banking, with JPMorgan Chase a 2025 leader.

- Industry: His mergers created giants like U.S. Steel, shaping global markets.

- Philanthropy: The Morgan Library and Met acquisitions enrich cultural heritage.

- Economic Policy: His crisis interventions spurred the Federal Reserve’s creation.

Controversies over his monopolistic power persist, with 2025 antitrust debates on X referencing his trusts. The Morgan Library’s digitized archives, per recent updates, and Vanderbilt University’s finance programs, funded by his heirs, extend his influence.

| Morgan’s Lasting Impact | Examples |

| Finance | J.P. Morgan & Co., Federal Reserve |

| Industry | U.S. Steel, General Electric |

| Cultural Influence | Morgan Library, Metropolitan Museum |

| Economic Legacy | Modern investment banking |

Conclusion

J.P. Morgan’s journey from a banker’s son to a financial colossus embodies vision and authority. His mergers and crisis interventions built modern industry and banking, while his philanthropy preserved cultural treasures.

Frequently Asked Questions (FAQs)

Who was J.P. Morgan?

J.P. Morgan was an American banker who founded J.P. Morgan & Co., orchestrated major mergers, and stabilized financial crises.

What is J.P. Morgan’s background?

Born in 1837 in Connecticut, Morgan was educated in Europe and rose through his father’s banking network.

How old was J.P. Morgan when he died?

Morgan died on March 31, 1913, at age 75.

Who was J.P. Morgan’s wife?

He married Amelia Sturges (1861) and Frances Tracy (1865–1913).

What is J.P. Morgan known for?

Morgan is known for creating U.S. Steel, resolving the Panic of 1907, and founding J.P. Morgan & Co.

What did J.P. Morgan contribute to finance?

He pioneered investment banking, stabilized crises, and shaped corporate consolidation.

Where did J.P. Morgan live?

He lived in Hartford, New York City, London, and Rome.

What exactly does J.P. Morgan do?

J.P. Morgan is a global financial services firm that provides a wide range of services including investment banking, asset management, wealth management, and commercial banking. The company helps corporations, governments, institutions, and individuals with raising capital, managing assets, making mergers and acquisitions, and offering financial advice. It is known for being one of the largest and most influential banking institutions in the world.

Is J.P. Morgan in Nigeria?

Yes, J.P. Morgan has a presence in Nigeria, although it operates primarily through representative offices and partnerships rather than full-service banking branches. The firm engages with Nigerian financial markets, assists with investments, and provides advisory services, particularly in corporate and investment banking. It plays an important role in connecting Nigerian markets to international finance.

What was J.P. Morgan famous for?

J.P. Morgan, both the man and the company, became famous for shaping the modern financial system in the United States. John Pierpont Morgan, the individual, was a powerful banker in the late 19th and early 20th centuries who helped finance railroads, major industrial corporations, and stabilized financial markets during crises. He was instrumental in creating U.S. Steel and consolidating various industries under large corporations.

Which country owns J.P. Morgan?

J.P. Morgan Chase & Co., the parent company of J.P. Morgan, is an American multinational financial institution. It is headquartered in New York City, United States. The company is publicly traded, meaning it is owned by shareholders from around the world, but it is fundamentally an American-owned and based entity.

Leave a Reply